1.

Select “Banking”2.

Enter your 6-digit Mobile PIN or use Touch ID / Face ID / Fingerprint

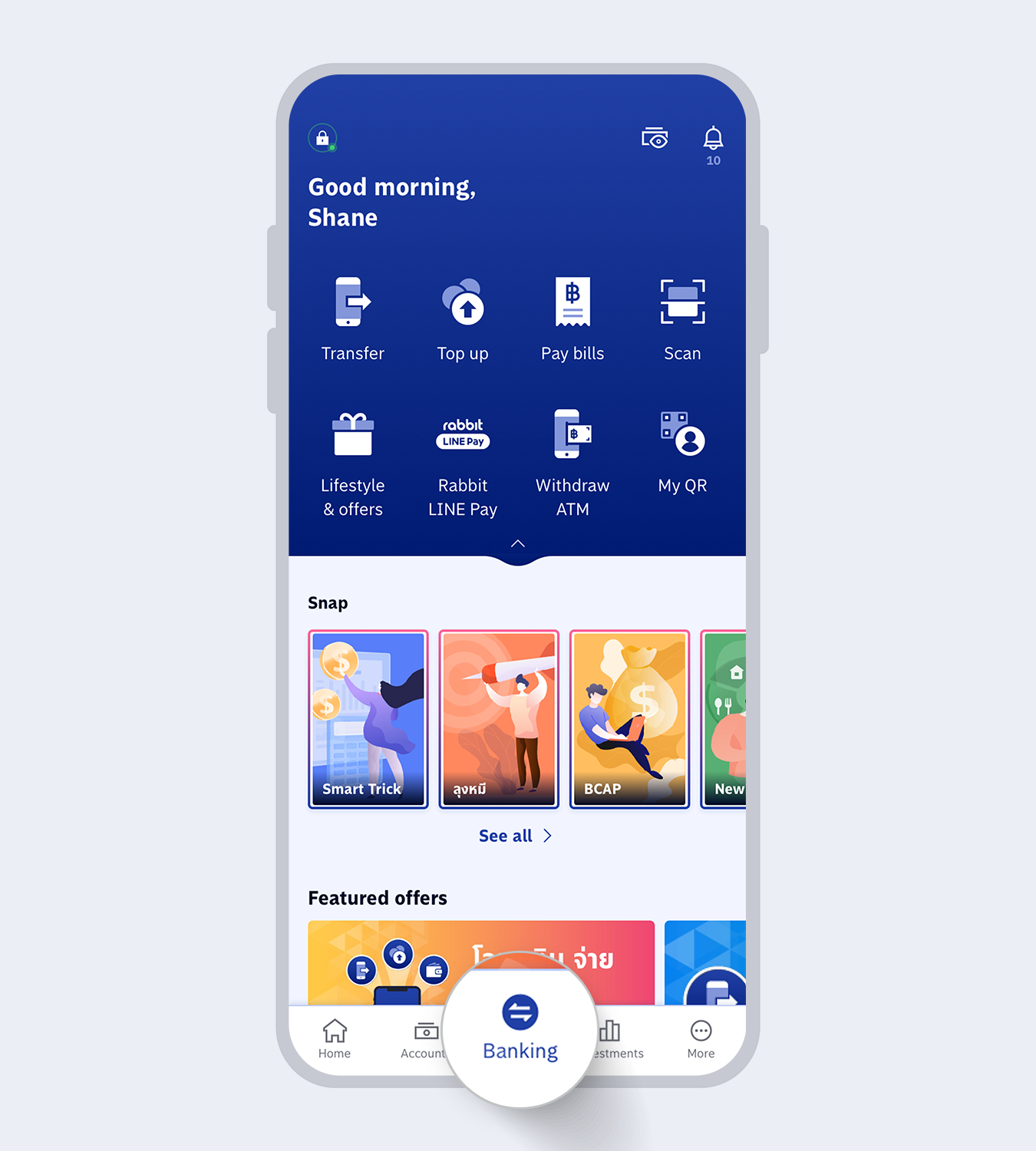

3.

Select “Int’l funds transfer”

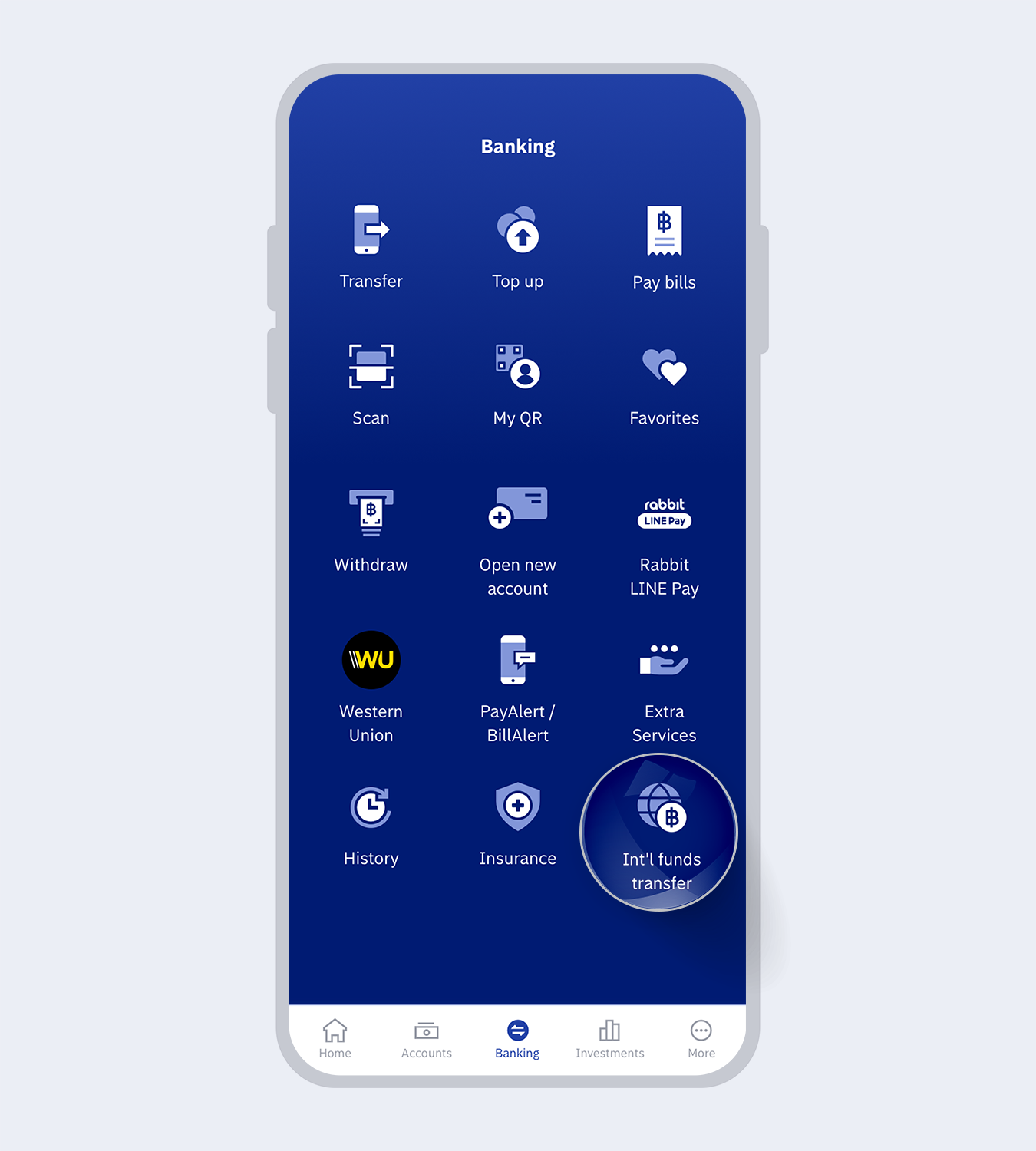

4.

Select “PromptPay International”

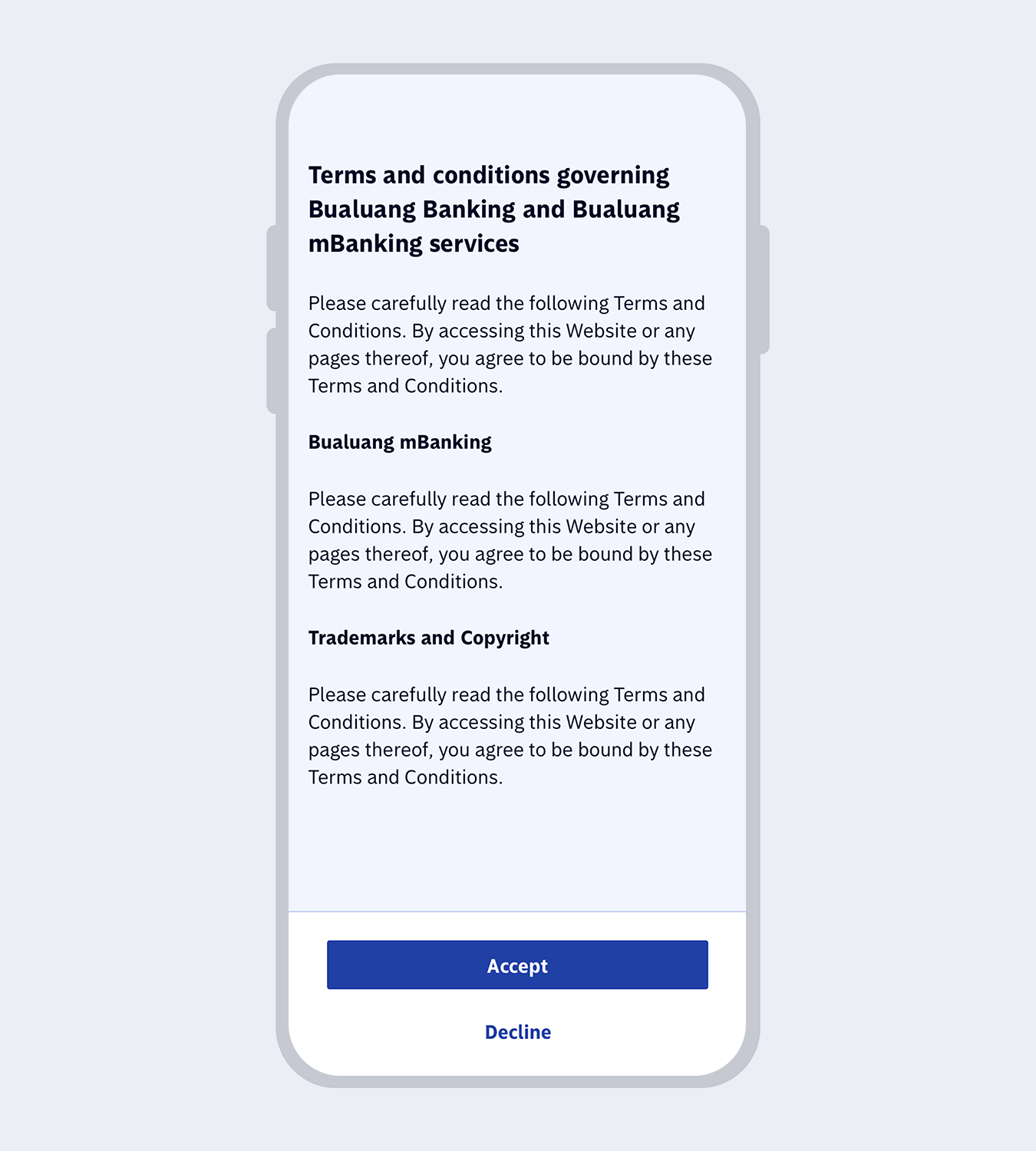

5.

Read the terms and conditions and select “Accept”

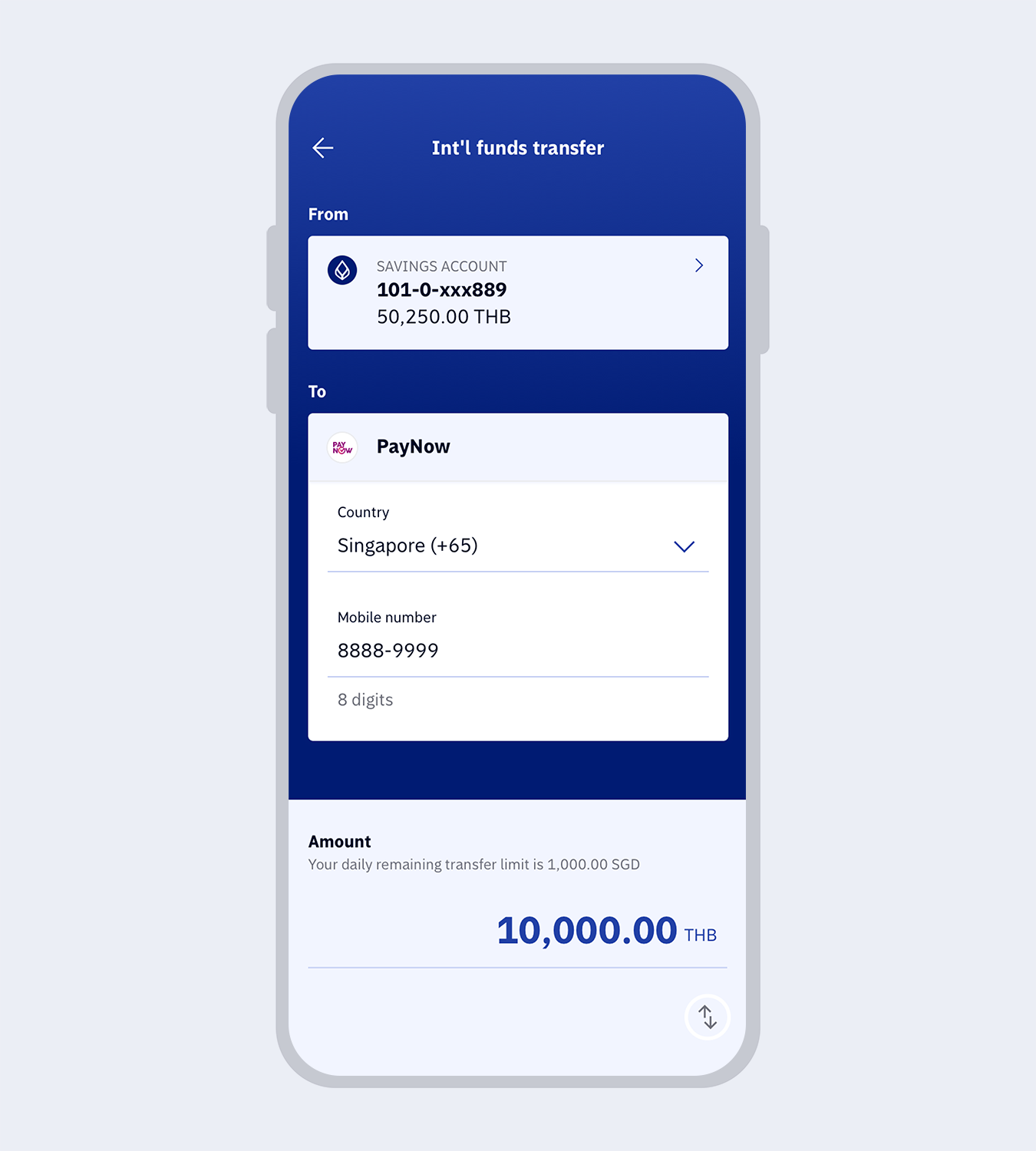

6.

Enter mobile number registered with PayNow (Singapore) and amount of money (THB or SGD) then select “Next”

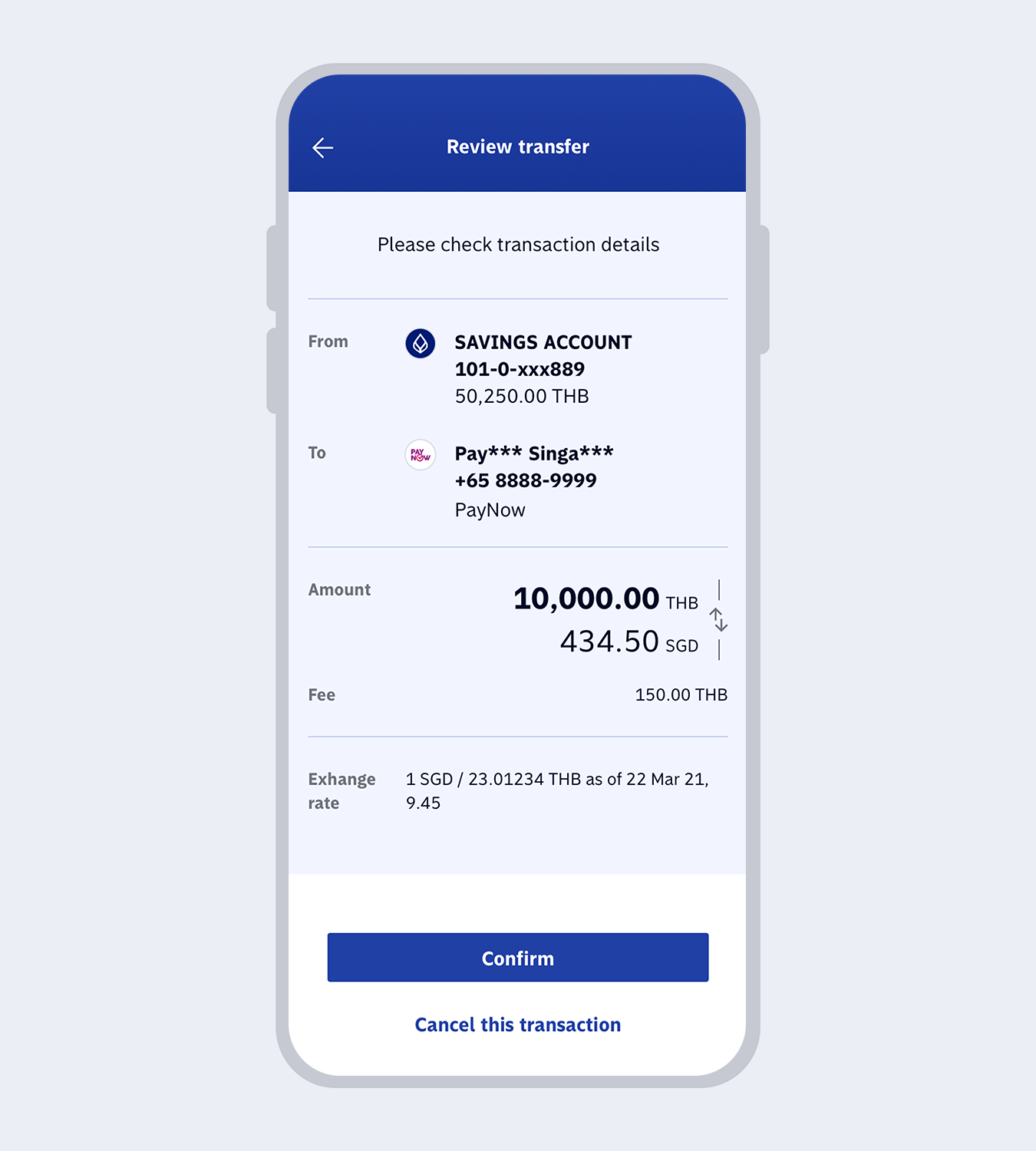

7.

Check transaction details and select “Confirm”

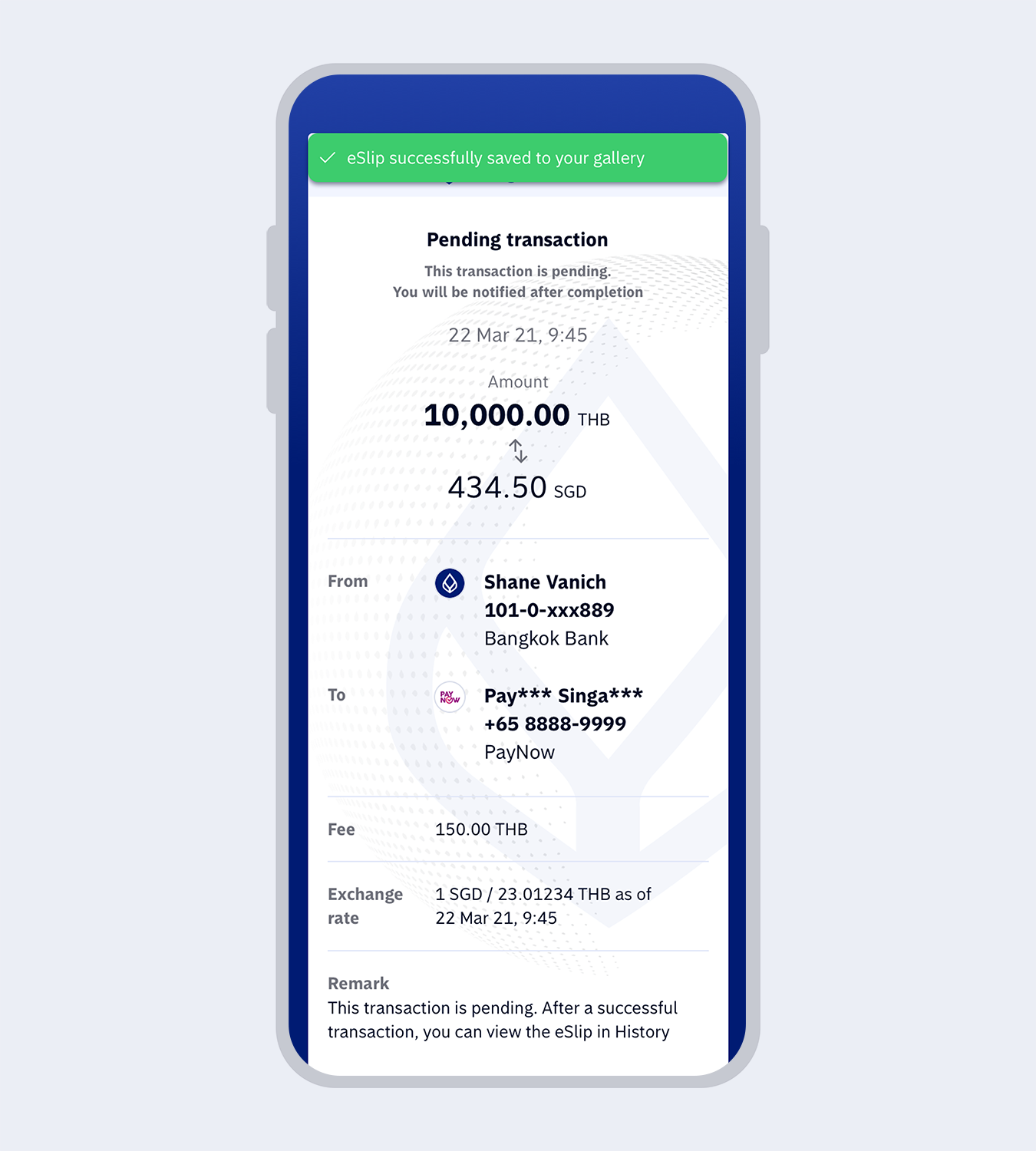

8.

Once the transaction is completed, you will receive your transaction e-slip.Remark: International transactions may take a few minutes to be processed and the status will be shown as Submitted. However, when the transaction is completed, you will receive a push notification or you can check the transaction status in “History”.