- Strategies

- Stakeholder Engagement

- Materiality Issues

- Sustainable Development Goals

- Engagement for Driving Sustainability

- Policies

Guidelines for Sustainable Business

Businesses today face challenges related to environmental, social and governance (ESG) aspects and these affect growth opportunities and competitiveness. However incorporating ESG into businesses helps the organizations to be able to adapt and turn challenge into opportunity. We recognize that stakeholders expect us to follow sustainable development practices while government and regulatory authorities encourage all businesses to be responsible for the environment and society under the principles of good corporate governance. Therefore, we have developed a clear systematic sustainability framework by establishing a sustainability policy and strategy that aligns with the Bank’s business direction. We have also incorporated materiality issues derived from the stakeholder engagement process as a baseline for strategy formulation while identifying commitments, key performance indicators, short-term and long-term targets for each materiality issue, so that the Bank’s sustainability business practices are systematic and have a clear direction that enables us to tackle challenges promptly and effectively.

Sustainability Policy

We have established our sustainability policy as a guideline for driving sustainable banking while supporting Thailand’s sustainable development. It is based on four key pillars as follows:

- Prudent and Comprehensive Risk Management covering significant issues in both the short and long term while keeping abreast of situations and assessing business opportunities resulting from changing economic, social and environmental conditions,

- Human Resource Management that treats employees equally and fairly without discrimination, provides for their occupational health and safety, and continually develops their knowledge and skills,

- Good Corporate Governance, and

- Sustainable Value Creation for Society and Environment through socially and environmentally responsible business conduct, financial education and inclusion that promotes access to financial services, participation in social services and supplier encouragement to conduct their businesses in a sustainable manner.

To ensure effective policy implementation, we place importance on building the fundamentals of sustainability governance, stakeholder communication and engagement, and capability building for directors, executives and employees at all levels.

Engagement of both internal and external stakeholders is pivotal to the Bank’s sustainable business conduct as it enables the Bank to better understand the expectations, needs and issues of its stakeholders. This understanding will lead to close collaboration for a better response to challenges and the mutually beneficial pursuit of new business opportunities. These actions, in turn, will enhance the development of our products and services to serve the needs of each group of stakeholders while preventing and mitigating any potential risks and negative impacts from carrying out our business. Through stakeholder engagement, the Bank will be able to create value and strengthen good relationships, laying a strong foundation for the Bank’s long-term sustainability. The Bank has classified its stakeholders into 7 groups as adapted from the Stakeholders Engagement Standard AA1000SES: 1. Shareholders and Investors, 2. Employees, 3. Customers (Business and Individual), 4. Counterparties (Suppliers, Service Providers and Contractors), 5. Creditors, 6. Industry Peers, and 7. Community, Society and Environment (including Regulatory Authorities, Public Sector and Mass Media).

Approaches to Stakeholder Engagement

- Materiality Issues

- Stakeholder Inclusivity

- Response to Stakeholder Expectations

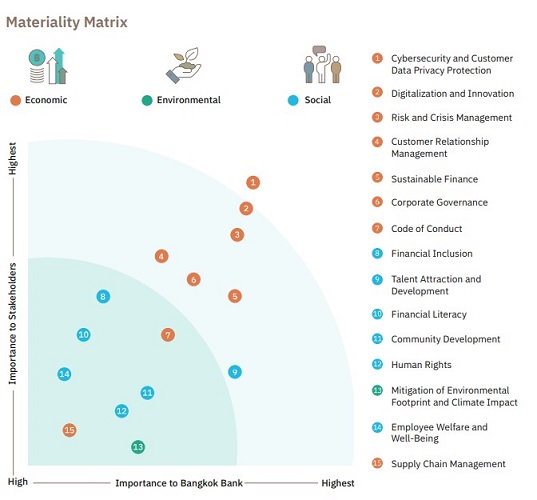

The Bank reviewed the existing materiality issues which had been in use since 2018 to update them to be line with and appropriate for the current situation and the next few years. In so doing, the Bank provided an opportunity to all stakeholders to express their opinions on all material aspects that are significant to the Bank, as well as to share their expectations, perspectives and suggestions on the Bank’s operations, in order to underscore the importance of creating value together with stakeholders. The Bank has applied various methodologies to gather information and feedback from stakeholders, such as questionnaires and in-depth interviews, in order to identify materiality issues.

Steps of Materiality Issues Assessment

- Identification

- Prioritization

- Screening and Examination

- Review

Materiality Issues Year 2020-2023

The Bank implements sustainability policies, guidelines and activities that promote the UN Sustainable Development Goals (UNSDGs). The Bank established five sustainability guidelines that are aligned with 15 materiality issues, each of which has been incorporated as a part of the Bank’s strategy to meet the expectations of all stakeholders and to jointly create value for the economy, society and the environment and to support the sustainable growth of the Bank.

We believe that all sectors including business, government and people, are mutually accountable for achieving sustainable development goals. Accordingly, we prioritize collaboration with other parties in driving sustainability efforts throughout the year. In 2022, the Bank joined the environmental, social and governance (ESG) declaration organized by the Thai Bankers’ Association. In this declaration, it defines business direction for the banking sector to work together to tackle key ESG issues, raise awareness for stakeholders and support Thailand's transition to achieve the UN Sustainable Development Goals and the Paris Agreement. Meanwhile, the Bank had a booth at the Sustainability Expo 2022 and APEC 2022 where we presented our efforts and projects that support sustainability goals. These collaborations reflect our commitment to direct our organization toward sustainability and, together with other sectors, jointly promote Thailand’s sustainability.

The Bank has continued to promote partnerships with various organizations and networks including government agencies, private organizations, associations, boards of trade and educational institutions through financial support in the form of membership fees and donations for activities that help strengthen the economy and society. Furthermore, the Bank participates as a member of both governmental and private organizations to create value for stakeholders including society and environment. Our financial contributions are based on social responsibility to give back to society while we refrain from supporting political activities or lobbyists.

The Bank places an importance on supporting and collaborating with other sectors to help driving Thailand to sustainable growth, including achieving Thailand greenhouse gas emission target and the Paris Agreement target. The Bank’s executives joined committees and working teams of the related organizations or associations to collectively provide policy recommendation to the government towards climate change and transition to renewable and clean energy, as well as to encourage and support other sectors to be able to transition to low carbon economy and achieve Thailand GHG emission reduction targets through implementing projects, organizing knowledge sharing activities, and communicating.

The key committees and working groups are:

- Sustainable Development Working Group, Energy Working Group, and Climate Change Sub-working Group, the Joint Standing Committee on Commerce, Industry and Banking (JSCCIB)

- Energy Committee, the Thai Chamber of Commerce

- Renewable Energy and Carbon Credit Trading Committees

- Sustainable Development Working Group, the Thai Bankers’ Association

The approval from the Bank’s management is required before an executive joins the committees or working groups, and the approval from the Bank’s committees is required before the Bank joins an organization or association as a member. When making the decisions to participate, the Bank takes into account the objectives and activities of the organizations and associations whether they conform to the Bank’s policies and business directions, including whether such participation leads to benefits to the society.

- Corporate Governance Policy

- Board Diversity Policy

- Code of Conduct and Business Ethics

- Supplier Code of Conduct

- Tax Policy

- Anti-Corruption Policy

- Anti-Money Laundering and Counter Terrorism Financing (AML/CFT) Policy

- Whistle Blowing Policy

- Corporate Social Responsibility Policy

- Human Rights Policy

- Sustainability Policy

- Responsible Lending Policy

- Environmental and Energy Conservation Policy

- Non-discrimination and Anti-harassment Policy

- Occupational Health and Safety Policy