Promotion of Financial Inclusion for Individual Customers

Banking Agents

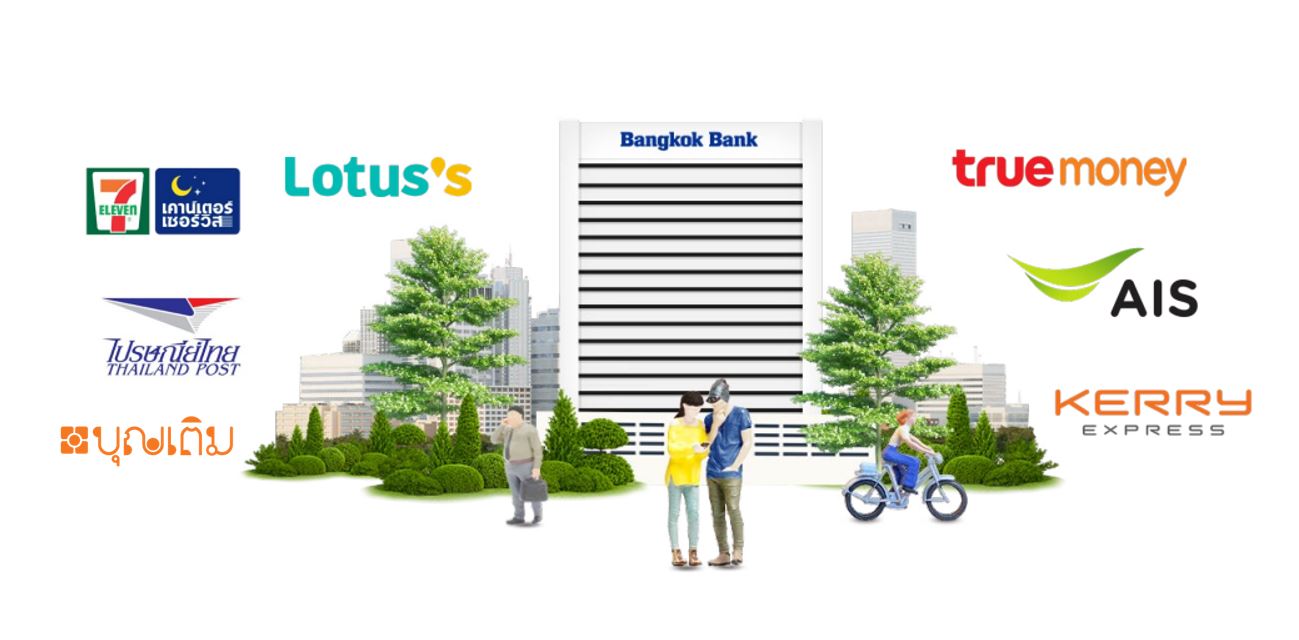

We continually extend our services through banking agents so that various groups of customers can make banking transactions more conveniently and inclusively anywhere anytime, especially those in rural communities and remote areas, or those with difficulties going to bank branches during working hours, or have no access to digital channels such as Bangkok Bank Mobile Banking or Bualuang iBanking. Banking agents include 7-Eleven, Lotus’s, Thailand Post, Boonterm kiosks, True Money, AIS and Kerry Express, which together offer service points in all provinces across Thailand. At the end of 2022, we had a total of 181,307 banking agents distributed across Thailand with more than 300,000 users using the services and more than 8.13 million transactions conducted through banking agents, of which cash deposits and withdrawals accounted for more than 7.29 million transactions.

Bualuang ATM and Self Services

In 2022, we partnered with Ngern Tid Lor to provide withdrawal services using Ngern Tid Lor cash cards through Bualuang ATM, and collaborated with AEON Thana Sinsap (Thailand) to offer cardless cash withdrawal services using Bualuang ATM via the AEON Thai Mobile application. We also provide automatic phone banking services 24 hours a day (Bualuang Phone 1333) for customers to make inquiries, transfer money, pay for services, top-up mobile phones, order check books, inquire about account balances, and pay credit card bills, as well as to help them access fund services and other services by themselves, or they can contact Call Center staff to access services. This helps accommodate customers as they have more options in accessing services conveniently and safely. Moreover, we have developed a special function to facilitate financial transactions for visually impaired people. This service does not only respond to the daily cash needs of visually-impaired people, but also promotes convenient and secure self-services.

Bangkok Bank Mobile Banking and Bualuang iBanking

We continually develop Bangkok Bank Mobile Banking to be up-to-date, easy-to-use, convenient, fast and safe to meet the needs of all customer groups and promote financial inclusion anytime anywhere. Customers can manage their finances in one place using this application, with services ranging from savings account opening, transfer-withdraw-top up, bill payment and investment management, to identity verification without the need to visit a branch. The Bank also offers Bualuang iBanking services for customers to manage their finances with ease, convenience and safety anywhere anytime through computers and tablets. The services on Bualuang iBanking include checking transaction history and account balance, money transfer, bill payment and funds management service.

e-Savings Account

We offer e-Savings accounts to promote financial inclusion in the digital age as interested customers can open an e-Savings account by themselves either through digital channels or branches whenever and wherever they want free of charge with no minimum deposit requirement or fee for cross-border transactions. Furthermore, we have implemented the identity verification system using Citizen ID cards (Be My ID) at branches and service points of banking agents across Thailand. These services reduce both the financial and non-financial costs of account opening, which helps promote financial inclusion and the use of digital channels to make transactions. Interested persons can open an account by themselves through Bangkok Bank Mobile Banking.

Cross-Border QR Payment Services

To support economic activities in ASEAN in collaboration with the Bank of Thailand and other central banks of ASEAN countries under the ASEAN Payment Connectivity plan, we have developed QR Code cross-border payment services enabling customers to scan QR Codes to pay for products and services in foreign countries using Bangkok Bank Mobile Banking with convenience and safety. The service is free of charge, exchange rates are real-time when making the transaction and customers will receive e-slips immediately as confirmation of a successful payment. At present, customers in Vietnam, Indonesia, Malaysia, Singapore and Cambodia can use our service without having to carry cash in foreign currencies. This is a convenient service for tourists, business people and migrant workers as well as providing more business opportunities for retail shops and vendors, especially in the tourism industry.

Basic Savings Accounts for State Welfare Cardholders and Those Aged 65 Years and Above

We promote financial inclusion and financial literacy through offering the Basic Banking Account for people with low incomes under the State Welfare Program and those aged over 65. This service features no minimum deposit requirement, an account maintenance fee waiver, and no opening fee or annual fee for debit cards linked to the account. This helps reduce the cost of maintaining a deposit account and getting access to financial services for target customers. At the end of 2022, there were over 51,795 users of Basic Banking Accounts with more than 2.8 million transactions.

Promotion of Financial Inclusion for SME and Farmers

Loans for SME

The Bank believes in the potential of Thai SME and is keen to support them through offering capital and knowledge to promote growth and competitiveness. We developed and launched a variety of tailored loan products to meet their diverse needs, such as Business Loans for Business Flexibility, Bualuang Loans for Franchise Business, Bualuang Green Loans, Loans for Gas Station Dealers, Bualuang Perm Sub (Loan) and Bualuang Poon Sub (Revolving Credit), targeting SME who have active trading activities with the Bank.

Click

Modern Agriculture Project and Loans for Farmers and Agricultural Businesses

The Bank realizes the importance of the agricultural sector and the limited access to capital that farmers and SME face. We have therefore continuously supported farmers and agricultural businesses by providing financial services and education about agricultural production, value-added creation, marketing and energy management to reduce greenhouse gas emissions through modern agriculture projects and other efforts led by relevant business units.

Provision of Financial Literacy to Customers and the Public

Online Financial Education

We encourage people of all age groups and genders to have a good understanding of financial planning, saving and investment to ensure their financial stability, by sharing useful knowledge and research via online channels such as Smart Finance with Money Tutor on the Bank’s website, Bangkok Bank Mobile Banking, LINE Official, Bangkok Bank Facebook page and Bangkok Bank Family Banking page, and distributing interesting articles and audiobooks via the Read for the Blind application for the visually-impaired. The Bank expects that these activities will help raise awareness and promote good understanding to society. We also support financial literacy for businesses and educational institutions by inviting lecturers, experts and executives to share useful knowledge with employees and students.

2S (Saving and Service)

The Bank promotes financial knowledge and understanding for people of all age groups, covering children, people of working age and retirees, through the 2S (Saving and Service) project that raises awareness on the importance of financial planning and recommends useful financial products suitable for different stages of life. In 2022, the Bank encouraged employees to organize educational sessions and build relationships with students, teachers and guardians in various educational institutions under the 2S for Kids project. Our employees shared information about basic financial management, both online and on-site, with 25 schools with 2,570 students attending.

Financial Education Project for Visually Impaired People

We have continuously organized activities to provide equal learning and access to financial services for visually impaired people. In 2021, we launched “Fin Lit for the Blind” to produce a guide to conducting financial transactions for visually-impaired people and selected articles or books with useful financial knowledge on financial planning, debt management and recommendations on financial and investment products to create audiobooks for the Read for the Blind application developed by the Thailand Association of the Blind. The project also provides a training program for Bank volunteers to learn how to read clearly and accurately with the recording quality tested before distribution. Altogether 116 of our employees have participated in this initiative and visually impaired people have accessed the audiobook service more than 3,200 times.

Unlocking Debt – Happy Retirement

With mutual commitment to solve debt problems and mitigate social inequality, the Bank and Noburo Platform (Noburo), a social startup, jointly launched a campaign Unlocking Debt – Happy Retirement to raise awareness about personal finances for employees of participating companies and provide advice on proper financial planning. The initiative aims to encourage sensible spending and repayment of excessive debts including those from loan sharks (using Noburo’s tools) to help participants to be able to save money for the future. Khaolaor Laboratories and A.I. Technology entrusted the Bank and Noburo to tackle their employees’ debt issues and 78 employees participated in the initiative and 38 volunteers offered to join the debt repayment as a hands-on assignment which have resulted in the amount of 1,112,850 Baht for debt repayment (Data collected from October 2022 to May 2023). Also, the Bank has closely monitored the debt repayment outcome of these volunteers. We hope that the campaign will help employees of participating companies to improve the quality of their lives, live sustainably and that this in turn will inspire others with debt problems to resolve them and save enough for their retirement.

Bangkok Bank SME (Puan Koo Kit SME)

We advocate stable growth of SME through offering various credit products and supporting a knowledge sharing network under the name Bangkok Bank SME. This covers multiple communication channels including our website, Facebook, YouTube, Instagram and podcast applications such as Spotify, SoundCloud and Podbean. Our online social network offers news and information useful for SME in the form of articles, analyses and video clips of successful customers sharing experiences, as well as online training and seminars under the concept Cost Cutting Through Clean Energy. The network also presents interesting programs such as SME Clinic Exclusive, SME Successor, Creative SME, Fininvest, Fininsight and The Treasury Talk. Also, online articles are published in a business series under Mega Trends and Business Transformation, Family Business and ESG section.